CryptoXTP Index

Less risk, better performance

Risk adjusted crypto asset strategy designed for exceptional results

CryptoXTP

A Risk-Adjusted Index of

the Leading Cryptocurrencies

Cryptocurrency markets are known for their extreme volatility. A glance at historical price charts reveals how quickly new tokens can rise and fall—often more dramatically than assets in traditional financial markets. Even well-established projects experience sharp and unpredictable price swings.

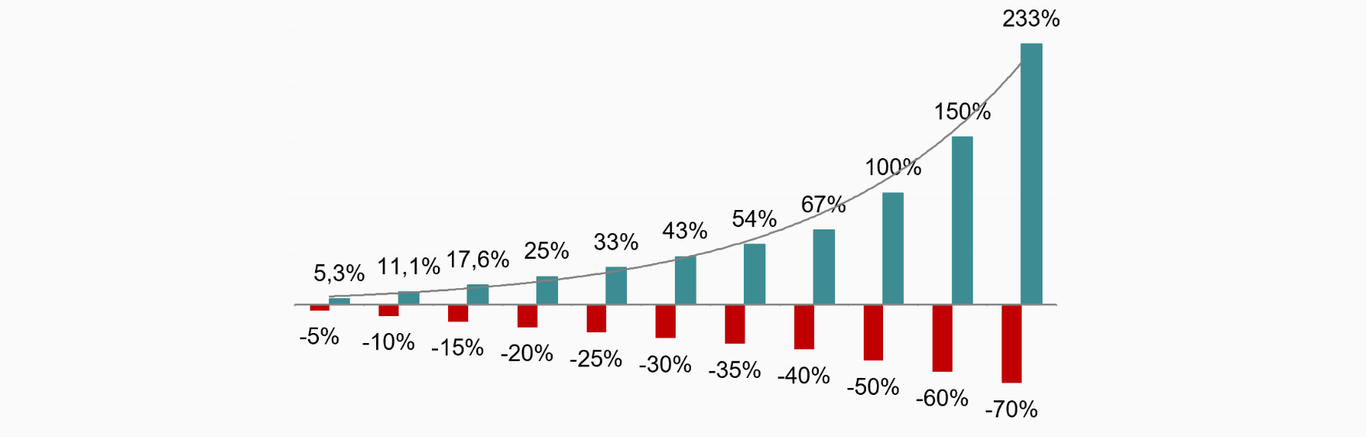

Our investment philosophy is grounded in a key principle: as losses increase, the gains required to recover them grow disproportionately. For example:

- A 10% loss requires an 11% gain to break even

- 25% loss needs a 33% gain

- 70% loss demands a 233% recovery

- A loss of 100%... ok, you got it!

These kinds of drawdowns are not uncommon in crypto markets, making capital preservation essential.

The CryptoXTP Index addresses this challenge by combining the most successful cryptocurrencies (X) into a risk-adjusted Tangential Portfolio (TP). The strategy is designed to minimize risk and volatility—especially extreme drawdowns—without sacrificing long-term growth potential.

By focusing on intelligent risk management, the CryptoXTP Index aims to significantly outperform a traditional equally weighted crypto portfolio over the medium to long term.

About us

Knowledge, Experience and Passion for Data

The perfect combination of opportuinities and personal skills is key to achieve outstanding results.

Knowledge

Knowing what you know and knowing what you do, that is knowledge.

Konfuzius

The mind behind the CryptoXTP Index is Michael Schnoor. Michael is one of the German pioneers in structuring risk-adjusted equity strategies.

As part of his scientific work in the late 1990s, he deep dived into mathematical models to structure risk optimized stock portfolios with a focus on Minimum Variance.

Experience

Experience is not what happens to you. Experience is what you make of what happens to you.

Aldous Huxley

The CryptoXTP Index team combines more than 50 years of experience in asset management and structuring quantitative investment approaches, especially in the field of risk management.

What we learned from the challenges of the stock market over time has enabled us to build a bridge to the fascinating investment word of crypto assets and to create an exceptional investment approach.

Passion for Data

Garbage in, garbage out!

Smart Mathematician

The ground work of any cryptocurrency is accurate data. Without clean, reliable data, everything is nothing and no blockchain would survive a single day, or even come into existence.

The CryptoXTP Index is based on data - such as price time series or risk data - which are obtained from highly reliable, decentralized sources.